Basic Black Scholes Option Pricing and Trading Pdf

Vollib - vollib is a python library for calculating option prices implied volatility and greeks using Black Black-Scholes and Black-Scholes-Merton. These models are implemented using a variety of numerical techniques.

Ppt Black Scholes Options Pricing Model Bsopm Sanjukta Sen Academia Edu

Lognormal and Monte Carlo price simulation.

. The topics include the definition of various financial securities and instruments eg. Right to buy or sell an asset at a fixed price on or before a given date Right buyer of option has no obligation seller of. ASSIGNED PROBLEMS FROM THE TEXTBOOK V.

The BS options pricing calculator is based on the Black and Scholes options pricing model which was first published by Fisher Black and Myron Scholes hence the name Black Scholes in 1973 however Robert C Merton developed the model and brought in a full mathematical understanding to the pricing formula. This particular pricing model is highly. We can hedge it by buying a share of the underlying asset.

The BlackScholes equation is a parabolic partial differential equation which describes the price of the option over timeThe equation is. In general standard option valuation models depend on the following factors. Full PDF Package Download Full PDF Package.

Download Full PDF Package. EXERCISE FOR PAYOFF DIAGRAM IV. Binomial and Black-Scholes pricing modelsOption Greeks delta and gamma hedging market maker profit theory.

The central and un nished task of asset pricing theory is to understand and measure the sources of aggregate risk that drive asset prices. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. Problems and Solutions Manual to accompany Derivatives.

Interest rate models and volatility. Black -Scholes Option Pricing Model 1973 BSOPM E. The standard Black Scholes option pricing model assumes that every option strike price should consider the volatility of the underlying security is the same for all strikes.

This assumed volatility shows up as the implied volatility on options chains or IV. The current market price of the underlying security. More sophisticated models are used to model the volatility smile.

Geometric Brownian Motion and Itos Lemma. These 19 sales and trading interview questions are most likely to come up at leading investment banks such as Goldman Sachs JP. 20 Full PDFs related to this paper.

Citation needed This hedge in turn. For example if we write a naked call see Example 52 we are exposed to unlimited risk if the stock price rises steeply. Black-Scholes option pricing is the classic example of this approach.

Bonds stocks forward contracts and options the theory of interest the No-Arbitrage Principle measures of return and volatility the Markowitz model of portfolio theory the Capital Asset Pricing Model the pricing of forward contracts option trading strategies the pricing of options via binomial. It turns out this Black Scholes assumption is bad because as people found out in the 1987 crash stocks can. 14 Full PDFs related to this paper.

Pyfin - Pyfin is a python library for performing basic options pricing in python. A short summary of this paper. Asian barrier compound gap and exchange options.

In relative pricing we infer an assets value given the prices of some other asset. Of course this is also the. Vollib implements both analytical and numerical greeks for each of the three pricing formulae.

Black-Scholes Equations 1 The Black-Scholes Model Up to now we only consider hedgings that are done upfront. Sales and trading interview questions can be some of the toughest in all of finance. QuantPy - A framework for quantitative finance In python.

A key financial insight behind the equation is that one can perfectly hedge the option by buying and selling the underlying asset and the bank account asset cash in such a way as to eliminate risk. This is done at the initial time when the call is. Download Full PDF Package.

INTRODUCTION BASIC TERMS 1. Full PDF Package Download Full PDF Package. The most basic model is the BlackScholes model.

A short summary of this paper. The strike price of the option particularly in relation to the.

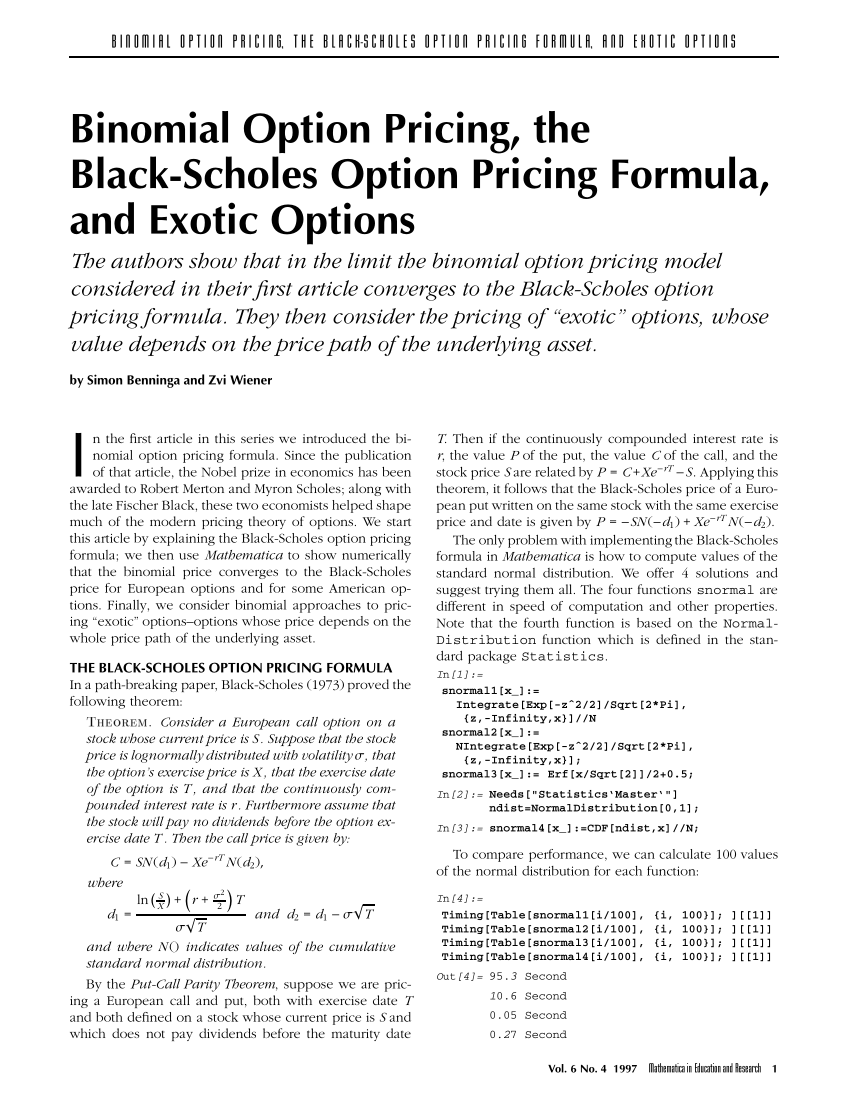

Pdf Binomial Option Pricing The Black Scholes Option Pricing Formula And Exotic Options

Basic Black Scholes Option Pricing And Trading Revised Fourth 9780994138682 Amazon Com Books

Basic Black Scholes Option Pricing And Trading Revised Fourth 9780994138682 Amazon Com Books

Commodity Option Pricing A Practitioner S Guide The Wil Https Www Amazon Com Dp 1119944511 Ref Cm Sw R Pi Dp X S3 Investing Books Option Pricing Finance

Pdf Black Scholes Option Pricing Model Robert Conroy Academia Edu

Trading Option Greeks How Time Volatility And Other Pricing Factors Drive Profit Bloomberg Financ Option Trading Trading Courses Options Trading Strategies

0 Response to "Basic Black Scholes Option Pricing and Trading Pdf"

Post a Comment